Through syndicated study ‘Little Voices’, speaking to consumers every other month, we have been tracking parents purchasing behaviours and keeping brands informed. With us fast approaching Christmas and this year looking very different to any other, we highlight some of the latest insights among parents as we head into our second lockdown.

Online speeds up…

Brick and mortar stores have once again closed their doors with only essential stores remaining open. During the first lockdown in the UK, parents unsurprisingly migrated towards shopping online with 83% of parents shopping in this way and over a third saying that they had shopped through click and collect. As we emerged from our first lockdown, we did see parents returning to stores and using online and in-store to complement each other, with many wanting to support their local high streets. However, when we asked parents last week ahead of our second lockdown where they will doing their Christmas shopping, nearly two thirds said they will take an online only approach with many not wanting to wait or rely on stores reopening ahead of the big day.

…As play slows down

It’s not just where parents shop that has had to evolve but their motivations to purchase have too. With the recent release of Dream Toys predicted top toys and games for Christmas 2020, it is clear that products that can both entertain for longer periods of time and also work for the whole family come out on top, the complete top 12 list can be found here. There has subsequently been a move away from collectables and short-lived toys in favour of ‘slow play’ toys like Barbie and other imaginative products that inspire kids to role play, playing over and over again.

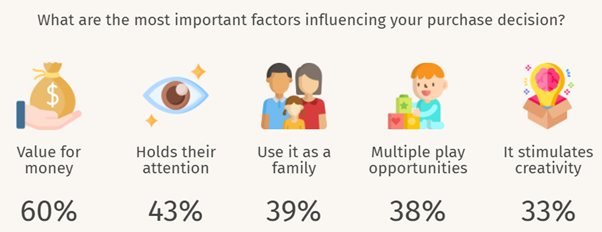

This notion of slow play has been reinforced in our own research, with parents top needs to purchase Christmas gifts for their children including the ability to hold their child’s attention, being able to use it as a family and it having multiple play opportunities.

These needs of family entertainment and getting the best value for money through long term engagement are not isolated to purchase decisions but we have seen them emerge as motivating factors for content selection too.

We are seeing an immediate impact on our behaviour as consumers as a result of the pandemic and these are no more apparent than as we approach Christmas, with where and how we shop evolving. But there are also longer-term implications that are likely to change the way we think about purchases and how products demonstrate good value for money. These will be imperative for bands to understand and respond to both in product development and across communications.

Little Voices is a survey that goes out to parents and kids aged 2-12 every other month, keeping track of media behaviours, brand engagement and purchase behaviours. If you would like to find out more about how you can be involved then please get in touch with us at [email protected].

Leave a comment